7 Steps for Testing Payment Workflows

Learn the essential 7 steps for testing payment workflows to ensure secure, reliable transactions and optimise payment systems.

Payment testing is essential for secure and reliable transactions, especially as digital payments are forecast to exceed £11.8 trillion by 2027. Here’s a quick summary of the 7-step framework to test payment workflows effectively:

- Set Up Test Environments: Use sandbox environments and configure test payment gateways securely.

- Develop Test Cases: Cover all payment flows, including checkout, subscriptions, refunds, and updates.

- Test Payment Methods: Verify cards, wallets, direct debit, and bank transfers for accuracy and compliance.

- Check Security: Ensure PCI DSS compliance and test for vulnerabilities.

- Assess Performance: Conduct load testing to handle peak transaction volumes.

- Analyse Results: Review logs, error codes, and transaction reports to identify issues.

- Implement Fixes: Validate fixes and roll out improvements to live systems.

Why it matters: 1 in 10 digital transactions fail, costing the industry £860 billion annually. Proper testing ensures your payment system is secure, fast, and user-friendly.

This guide breaks down each step with actionable advice to help businesses optimise payment systems and meet customer expectations.

What is a payment gateway and how does it work?

Test Environment Setup

Setting up a proper test environment is essential for verifying payment workflows without affecting live data. Here’s how to establish a secure and controlled testing framework.

Creating a Sandbox

A sandbox environment is an isolated space that mimics your live payment system. It allows you to test various scenarios safely and without any risk to actual operations.

To set up an effective sandbox:

- Create separate test accounts for each user role, such as customer, merchant, and admin.

- Configure environment variables to ensure no connection to live systems.

- Use monitoring tools to track test transactions and system behaviour.

”The PayPal sandbox is a self-contained, virtual testing environment that simulates the live PayPal production environment.” – PayPal

Test Payment Gateway Setup

Configuring your payment gateway in test mode is key to accurately simulating real transactions. Most major payment providers offer test environments with specific credentials and card numbers for different outcomes.

Here’s an example of test card data:

| Transaction Type | Test Card Number | Expected Outcome |

|---|---|---|

| Successful Payment | 4111111111111111 | Approval |

| Declined Payment | 4012888888881881 | Decline |

To ensure reliable gateway testing:

- Activate test mode in your payment gateway settings.

- Handle error codes for different scenarios.

- Set up webhook endpoints to receive transaction notifications.

- Use test API keys and credentials provided by your payment provider.

Test Data Preparation

Comprehensive test data is necessary to cover a wide range of payment scenarios. Your dataset should include:

- Various transaction types and payment methods across major currencies like GBP, EUR, and USD.

- Edge cases such as timeouts, network issues, and validation errors.

Payrix advises using data that closely resembles real-world conditions [2]. This approach helps uncover potential problems before they affect actual customers.

When creating test accounts, ensure strict separation from production data by using unique naming conventions and implementing robust access controls.

Test Case Development

Create detailed test cases to ensure payment workflows function reliably. This structured approach builds on your secure testing setup to cover all critical transaction elements.

Main Payment Flows

Focus on testing the essential payment processes across the entire transaction journey.

| Payment Flow | Test Objectives | Key Validation Points |

|---|---|---|

| Standard Checkout | Make sure transactions complete and receipts generate | Verify payment confirmation, order details, and email notifications |

| Subscription Setup | Activate recurring billing | Check initial charge, subscription details, and billing cycles |

| Refund Processing | Handle full and partial refunds | Confirm refund amounts and bank reconciliation accuracy |

| Payment Updates | Validate card detail changes | Ensure security checks and update confirmations |

Make sure amounts are processed correctly and VAT compliance is maintained for GBP, Euro, and other currencies.

Payment Method Tests

Test various scenarios for each payment method. Stripe’s documentation highlights the importance of testing payment methods commonly used in the market you are building in / for:

- Credit/Debit Cards (e.g. Visa, Mastercard, American Express)

- Digital Wallets (e.g. Apple Pay, Google Pay)

- Direct Debit

- Bank Transfers

”Writing test cases requires testers to think creatively, as creating scenarios and cases that could potentially uncover hidden bugs or defects in the software can be challenging.” – Testsigma

For each method, check processing times, payment confirmations, banking integration, and compliance with the country’s financial regulations.

Error Handling Tests

Test error scenarios to ensure the system responds correctly and provides clear guidance to users:

- Transaction Failures: Declined payments, insufficient funds, or expired cards.

- System Timeouts: Manage timeouts during peak usage periods.

- Validation Errors: Handle invalid card numbers, expired dates, incorrect CVVs, or missing fields.

Error messages should be clear and written in plain, user-friendly UK English.

Testing Methods

To ensure payment workflows function smoothly, it’s important to use both automated and manual testing methods. This combination provides thorough and dependable coverage.

Automation Tools

Automation tools are excellent for handling repetitive payment tests efficiently:

Selenium Suite

- WebDriver: Enables cross-browser payment testing on platforms like Chrome, Firefox, and Safari.

- IDE: Simplifies the creation of test scripts for payment forms and checkout processes.

- Grid: Allows distributed testing across different environments, ensuring regional payment methods work as expected.

”Selenium automates browsers. That’s it!” – Selenium

Cypress operates directly within the browser, making it easier to verify payment processes without the need for complex setups.

While automation handles routine tasks, manual testing is essential to confirm how real users interact with the system.

Manual Testing Steps

Manual testing ensures configurations are correct, usability is smooth, and edge cases are handled properly:

- Initial Setup Checks: Verify that payment methods are configured correctly and visible in the test environment. Confirm the display of currency symbol(s) and compliance with VAT rules, if any.

- User Experience Testing: Check form validation, the flow of payment method selection, error messages in the correct language, and transaction confirmation screens.

- Edge Case Scenarios: Test situations that automation might miss, such as:

- Handling multiple currency conversions

- Payment gateway timeouts

- Behaviour when using the browser’s back button

- Mobile responsiveness across various devices

Security and Performance

Security Standards

Ensuring secure payment workflows is super important. The Payment Card Industry Data Security Standard (PCI DSS) requires regular testing of security systems to safeguard sensitive payment information. Here are some key practices to follow:

- Automated vulnerability scanning: Regularly scan your systems to detect weaknesses and potential risks. These scans are typically done quarterly or after major system updates.

- Manual penetration testing: Employ skilled professionals to simulate attacks, exposing vulnerabilities that automated tools might overlook.

- Application security assessments: Evaluate payment applications for flaws that could put transaction data or customer details at risk.

Failure to comply with PCI DSS can result in hefty fines ranging from $5,000 to $100,000 per month.

| Testing Type | Frequency | Focus Areas |

|---|---|---|

| Vulnerability Scanning | Quarterly | Detecting known vulnerabilities and weaknesses |

| Penetration Testing | Annually | Identifying complex vulnerabilities through manual testing |

| Application Security | Continuous | Analysing code and checking runtime security |

In addition to security, it’s essential to evaluate system performance to ensure smooth payment processing during high-demand periods.

Load Testing

Load testing helps verify that payment systems can manage large transaction volumes without performance issues. This is especially important during peak times. When conducting load tests, take the following steps:

- Simulate peak traffic: Use historical data to model high transaction volumes, factoring in concurrent users and various payment methods.

- Track key metrics: Keep an eye on response times, resource usage, error rates, and transaction failures, including gateway timeouts.

Set clear performance benchmarks, test real-world scenarios, monitor system resources closely, and document everything for future improvements. This ensures your payment system remains stable and reliable under pressure.

Results and Fixes

Test Result Analysis

To identify issues in payment workflows, examine API logs and transaction reports carefully. Focus on:

- Request and response metadata: Look for inconsistencies or missing details.

- Transaction status codes: Identify errors or unusual patterns.

- Error messages in response bodies: These can point directly to the root causes.

- Payment processing timestamps: Delays can signal performance bottlenecks.

”Using API logs, you can see information about your API requests in the Customer Area. You can troubleshoot the requests and responses, and see the metadata of your API requests.” – Adyen

Did you know? 1 in 10 digital transactions fail, costing the industry a staggering $1.1 trillion annually.

| Test Result Type | Key Indicators to Review | Action Required |

|---|---|---|

| API Failures | Error code 422 | Check request body for invalid input |

| Transaction Reports | Missing entries | Verify logging configuration |

| Gateway Timeouts | Response delays > 30 seconds | Investigate network connectivity |

| Security Alerts | Unauthorised access attempts | Review authentication protocols |

These insights can help you quickly identify and prioritise fixes for critical issues.

Common Issue Fixes

Recurring problems often require targeted solutions. Here are two common challenges and how to address them:

- Security Vulnerabilities

Protect sensitive data by implementing SSL encryption and adhering to PCI-DSS standards. Regular security audits are essential for spotting weak points before they escalate into serious issues.

- Integration Challenges

Choose payment gateways with detailed API documentation and reliable SDKs. This simplifies integration, reduces errors, and speeds up development.

For example, Carry1st, an African gaming publisher and payments platform, partnered with Global App Testing for payment validation. This collaboration boosted their success rates from 78% to 90%, improving checkout completions by 12%.

Fix Verification

After applying fixes, do validate their effectiveness. Create an evidence package that includes:

- Before and after test results: Highlight the improvements.

- API response logs: Show resolved errors or improved responses.

- Transaction success rates: Measure the impact of changes.

- Performance metrics: Ensure no new bottlenecks have been introduced.

Test the fixes under varied conditions for at least two full payment cycles. Compare the new results with baseline metrics to confirm the improvements are reliable and consistent. Document everything for future reference.

Next Steps

Process Summary

Payment testing requires constant attention, focusing on these key areas:

- Transaction monitoring: Keep an eye on success rates and response times.

- Security compliance: Regularly update to meet PCI-DSS standards.

- Performance checks: Work on improving processing speeds.

- Error resolution: Fix issues promptly to avoid customer impact.

Thorough payment testing plays a crucial role in keeping your business running smoothly.

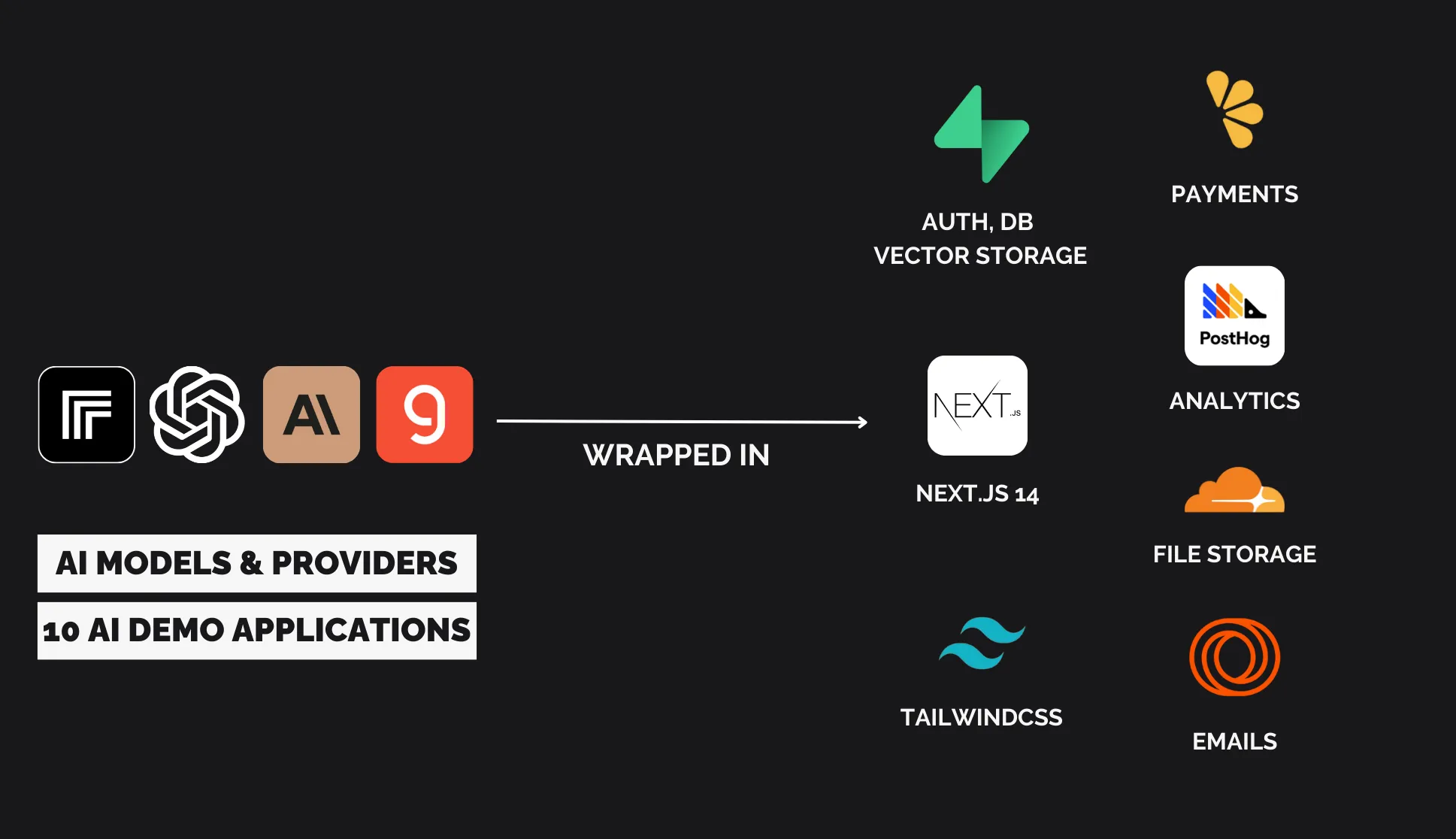

Best SaaS Boilerplates Integration

To simplify your testing process, consider using specialised tools like SaaS boilerplates and SaaS starter kits. They provide ready-made solutions designed to make payment testing easier. Some of their key features include:

| Feature | Benefit | Impact |

|---|---|---|

| Subscription Management | Automates billing flow testing | Cuts setup time by 40% |

| Payment Gateway Integration | Pre-set test environments | Saves 3–4 weeks of development |

| Security Protocols | PCI-DSS compliant templates | Ensures adherence to regulations |

Using these tools ensures your payment systems remain efficient and compliant.

Regular Testing Schedule

Establish a consistent testing routine to ensure your payment systems stay reliable:

- Daily checks: Review transaction success rates, error logs, and settlement completions.

- Weekly reviews: Evaluate performance metrics, test any new payment methods, and verify security measures.

- Monthly assessments: Perform load testing, update test scenarios, and review compliance standards.

Keep detailed records of all test results and system updates. This not only helps in maintaining compliance but also provides valuable insights for ongoing improvements.

Recommended SaaS Boilerplates

Below you’ll find three highly recommended SaaS boilerplates that have built-in payment workflows: