Best Practices for Payment Workflow Testing

Learn how to test payment workflows, ensure security, reliability, and compliance in financial operations for SaaS platforms.

Here’s what you need to know:

- Why It Matters: Prevent payment failures, protect revenue, and build customer trust.

- Key Challenges:

- Integration Complexity: Multiple gateways (e.g., Stripe, PayPal), currencies, and payment methods.

- Security: PCI DSS compliance, data protection, and fraud prevention.

- Technical Issues: Real-time processing, error handling, and multi-currency support.

- Testing Steps:

- Set up separate test environments with sandbox data.

- Simulate basic payment flows (e.g., subscriptions, refunds) and error scenarios (e.g., expired cards, insufficient funds).

- Test multi-currency handling and regional payment methods.

- Automation Tools: Use tools like Cypress, Selenium, or TestComplete for efficient, repeatable testing.

- Security Standards: Validate PCI DSS compliance, encryption, and fraud detection mechanisms.

- Load Testing: Ensure the system handles peak transaction volumes without failures.

Quick Tip: Use pre-built SaaS boilerplates like Shipped or Makerkit to simplify payment integration and testing.

Testing payment workflows isn’t just about functionality - it’s about ensuring a seamless, secure experience for users while maintaining compliance and system resilience.

Payment Gateway Testing Tutorials: Test Scenarios and Test Cases

Setting Up Test Environments

Dedicated test environments are essential for safely validating payment workflows and identifying potential issues early on.

Separating Test and Production

Keep your test and production environments completely separate to avoid interference. This involves using distinct test API keys and customized configurations. Here’s how you can set it up:

- Use separate domains: For example,

test-payments.yourdomain.comfor testing andyourdomain.comfor live transactions. - Add clear indicators: Make it obvious whether you’re in the test or production environment.

- Maintain separate databases: Keep testing data isolated from live data.

Creating Test Data Sets

Use specific test card numbers to simulate different scenarios. Here’s a quick reference:

| Test Card Type | Format | Purpose |

|---|---|---|

| Visa Test | 4111 1111 1111 1111 | Basic validation |

| Mastercard Test | 5555 5555 5555 4444 | Decline scenarios |

| AMEX Test | 3782 822463 10005 | International charges |

Key scenarios to test include:

- Transactions in USD, ranging from $0.50 to $999,999.99.

- Payments through various methods like credit cards, ACH, and digital wallets.

- Different billing cycles, such as monthly, annual, or custom plans.

Managing Test Environment Access

Control who can access your test environment to ensure security and proper oversight. Best practices include:

- Role-based permissions: Developers might need full access, while QA teams could have limited access.

- Audit logging: Track all activity to monitor changes and identify issues.

- Enforce strong security: Use strong passwords, two-factor authentication, and regularly rotate credentials.

Additionally, incorporate monitoring tools to detect unusual activity and alert administrators promptly.

Once your test environment is secure and functional, you can start simulating a variety of payment scenarios to refine your workflows.

Payment Test Scenarios

To ensure your payment system performs reliably, simulate these scenarios in a secure test environment.

Basic Payment Flows

Start by testing the core payment processes. These include:

- One-time payments: Confirm transactions are completed accurately and on time.

- Subscription starts: Check that subscriptions activate correctly and the initial billing is processed.

- Plan upgrades/downgrades: Ensure billing adjusts appropriately when users change plans.

- Authorization holds: Test initial holds on payment methods.

- Trial period charges: Verify charges are applied correctly after free trials.

- Recurring billing schedules: Confirm recurring payments follow the expected schedule.

- Mid-cycle plan changes: Validate adjustments when users switch plans mid-billing cycle.

- Grace period handling: Test how the system manages payments during grace periods.

- Refund processing: Handle edge cases to ensure refunds are processed without issues.

Once these flows are confirmed, move on to testing how the system handles errors.

Error Handling Tests

After validating successful transactions, focus on failure scenarios to ensure the system responds appropriately:

- Insufficient funds: Check decline notifications and recovery workflows.

- Expired cards: Test how the system prompts users to update their card details.

- Network timeouts: Ensure transactions aren’t duplicated during timeouts.

- Invalid card numbers: Verify error messages and recovery options are clear.

- 3D Secure failures: Test fallback authentication methods when 3D Secure fails.

Multi-Currency Support

If your system supports international payments, test for multi-currency handling to address global challenges:

-

Currency Conversion

- Confirm exchange rates are applied accurately.

- Ensure prices display correctly for different currencies.

-

Regional Payment Methods

- Test specific methods such as SEPA Direct Debit (Europe), Konbini payments (Japan), Alipay and WeChat Pay (China), and Boleto Bancário (Brazil).

-

Decimal Handling

- Validate the system handles currencies with unique decimal rules.

- Check transaction limits and correct placement of currency symbols.

Payment Test Automation

Testing tools simplify validation, reduce errors, and save time. They allow you to create test suites that consistently verify payment functionality.

Selecting Automation Tools

Once you’ve outlined your test scenarios, automation can boost both reliability and efficiency. Choose testing tools that work well with your payment gateway. Popular options include:

- Cypress: Ideal for end-to-end testing of payment flows, with built-in waiting features for handling asynchronous processes.

- TestComplete: Great for testing payment gateway integrations with robust support.

- Selenium: Offers broad browser compatibility, making it suitable for testing payment forms.

Here are some key factors to consider when choosing your tools:

| Factor | Consideration | Impact |

|---|---|---|

| Gateway Integration | Native support for your payment provider’s API | Reduces the need for custom coding |

| Security Compliance | PCI DSS compatibility | Ensures secure and compliant testing |

| Parallel Execution | Ability to run multiple tests simultaneously | Speeds up the testing process |

| Reporting Features | Detailed logs and test results | Simplifies debugging and auditing |

Building Test Scripts

Follow these best practices when writing test scripts:

- Modular Structure: Break payment workflows into reusable components.

- Data-Driven Approach: Keep test data separate from test logic to make updates easier.

- Failure Scenarios: Include detailed error-handling processes.

- Timeout Management: Set timeouts to handle potential payment processing delays.

For subscription-based systems, make sure your automated tests cover the entire payment lifecycle. For example:

describe("Subscription Payment Flow", () => {

it("should handle trial to paid conversion", async () => {

await startTrial();

await simulateTrialPeriod();

await verifyFirstCharge();

await confirmSubscriptionActive();

});

});

Incorporate these test scripts into your deployment pipeline to ensure continuous verification.

CI/CD Integration

Integrate payment tests into your CI/CD pipeline by using pre-deployment checks, scheduled tests, and automated alerts. For example:

notifications:

payment_test_failure:

channels:

- payment-ops

- dev-team

threshold: critical

response_time: 15m

Schedule tests during low-traffic hours and set up alerts for test failures. Platforms like Best SaaS Boilerplates offer pre-built templates to help you get started quickly and follow best practices. This integration helps maintain consistent validation as your payment system evolves.

Security Standards and Compliance

Ensuring secure payment workflows requires rigorous testing to safeguard transactions and maintain data integrity. Start with PCI DSS testing to evaluate network security, data protection, and access controls.

PCI DSS Testing

Verify that your payment system complies with these PCI DSS requirements:

| Requirement Category | Test Focus | Validation Points |

|---|---|---|

| Network Security | Firewall configurations | Segmentation, access controls |

| Data Protection | Encryption methods | Key management, transmission security |

| Access Management | User authentication | Role-based access, audit trails |

| Monitoring Systems | Security scanning | Intrusion detection, log reviews |

Key PCI DSS validations include:

- Encryption of card data during transmission

- Implementation of strict access controls for payment systems

- Regular security scans and continuous monitoring

Data Security Testing

Focus on these critical areas during data security tests:

- End-to-End Encryption: Check encryption for both data at rest and in transit.

- Tokenization: Validate token generation, storage, and retrieval processes.

- Key Management: Test encryption key rotation and access restrictions.

Specific validation steps:

- Data Masking: Ensure card numbers are masked in logs and user interfaces.

- Storage Security: Verify sensitive data is securely encrypted during storage.

- Access Logging: Confirm audit trails are created for all data access events.

Once data security is validated, the next step is to address fraud detection and prevention.

Fraud Prevention Tests

Simulate fraud scenarios to test detection mechanisms:

- Velocity Checks: Ensure limits on transaction frequency are enforced.

- Location-Based Rules: Validate geolocation and IP address checks.

- Amount Thresholds: Test transaction limits and splitting detection.

- Chargeback Prevention: Assess dispute management processes.

describe("Fraud Detection Tests", () => {

it("should flag rapid successive transactions", async () => {

await createTransaction(validCard, amount);

await createTransaction(validCard, amount);

const result = await getFraudScore();

expect(result.riskLevel).toBe("high");

});

});

Make sure your system accurately detects and responds to fraud attempts while minimizing false positives to avoid disrupting legitimate transactions.

SaaS Tools for Payment Testing

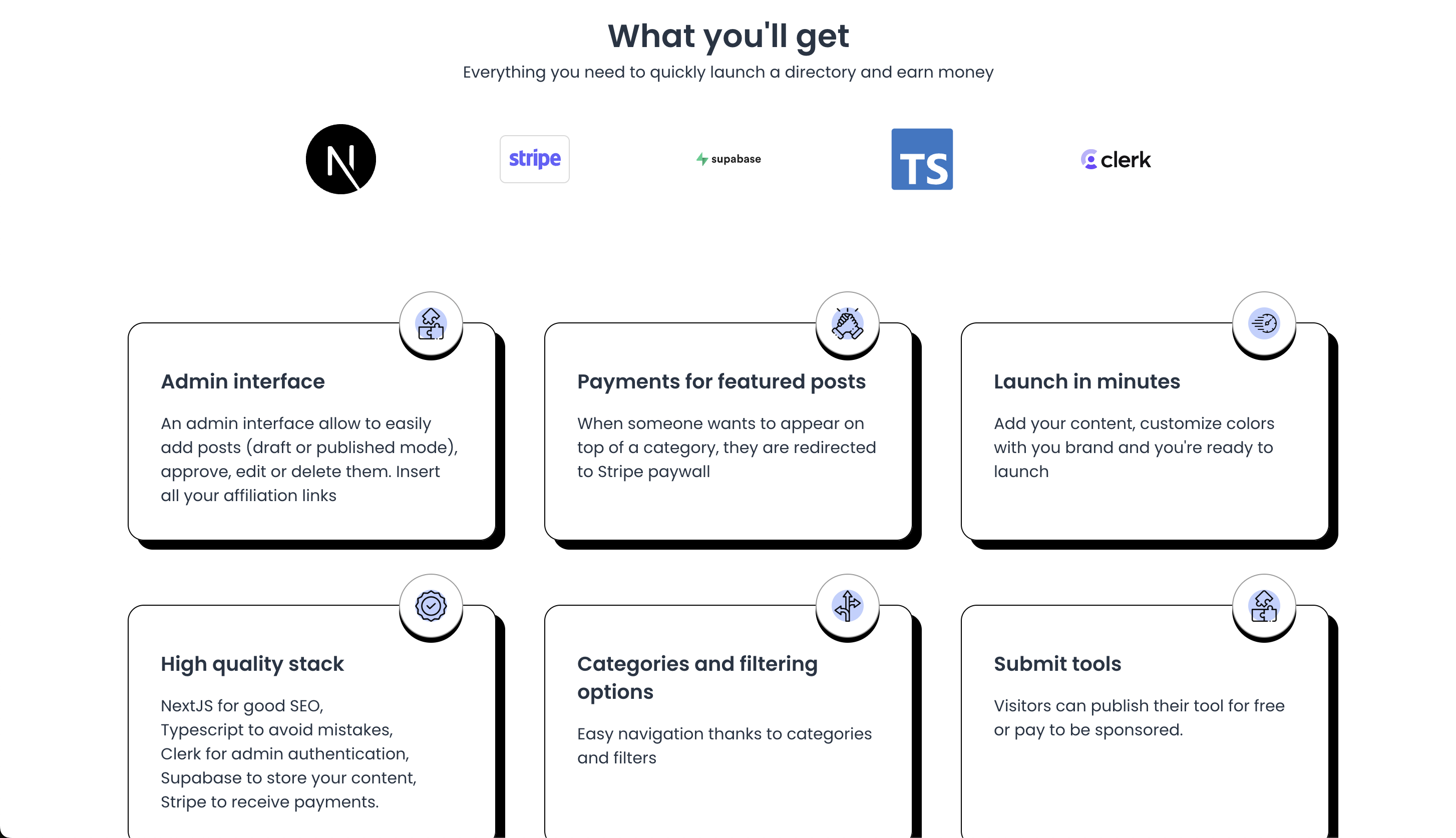

Modern SaaS boilerplates come with pre-built payment testing frameworks. These tools save developers from building payment infrastructure from the ground up, letting them concentrate on testing scenarios specific to their business needs.

Pre-Built Payment Features

SaaS boilerplates include integrations with major payment providers, making it easier to test payment-related functions. Here’s a quick overview:

| Feature Category | Purpose | Integrations |

|---|---|---|

| Payment Processing | Ready-to-use gateway connections | Stripe, PayPal, Braintree |

| Subscription Management | Automated billing cycle tests | Recurring payments, usage tracking |

| Error Handling | Edge case simulations | Failed transactions, declined cards |

| Multi-Currency | Currency conversion setup | Exchange rate handling, local pricing |

Popular options like Shipped (starting at $109), Makerkit (starting at $299) and Supastarter (also $299) provide robust payment testing environments with features such as:

- Test credentials for various payment providers

- Automated workflows for subscription lifecycle testing

- Pre-configured webhook handlers for payment events

- Tools to simulate payment errors

These frameworks make subscription and billing workflow testing much simpler and faster.

Testing with SaaS Templates

SaaS templates offer a systematic way to test subscription and billing workflows. They complement both manual and automated testing methods. For example, Nodewood (starting at $295) provides a JavaScript-based framework designed for subscription-focused applications. As one founder explains:

Save weeks or months of development time when you build with Nodewood - a JavaScript SaaS Starter Kit that provides an application scaffold, user authentication, subscription management, and more!

Key testing features include:

Subscription Testing

- Automated validation of trial periods

- Testing upgrade and downgrade scenarios

- Ensuring proper cancellation processes

- Verifying usage limits

Billing Integration Tests

- Checking payment method functionality

- Confirming accurate invoice generation

- Testing refund processes

- Ensuring correct tax calculations

Many boilerplates also integrate with continuous integration pipelines, enabling automated payment tests during development. For example, DjaoDjin (free) supports compliance testing, while SaaS Pegasus (starting at $249) includes utilities for subscription-based service testing.

Tim Cheung from Kickstart puts it well:

Don’t waste time reinventing the wheel. This boilerplate provides core features from authentication to payment integration, and everything in between.

These tools allow developers to focus on creating business-specific tests without worrying about the foundational payment infrastructure.

Load and Scale Testing

Payment systems need to handle large transaction volumes, especially during busy times like holiday sales. Load testing helps uncover weak points and ensures the system performs well under pressure. Let’s dive into how to test gateway performance and system capacity during heavy use.

Payment Gateway Load Tests

To test payment gateways effectively, replicate common transaction patterns. Pay attention to these areas:

- Processing Time: Measure how average transaction times change as the load increases.

- Concurrent Requests: Evaluate how well the system manages multiple payment requests at once.

- Failed Transactions: Track the rate of failed transactions under different loads.

- System Stability: Ensure the system remains stable during extended periods of heavy use.

High-Volume Testing

High-volume testing pushes the system beyond its usual limits. Here’s how to approach it:

- Simulate diverse user actions and transaction amounts.

- Gradually increase the load to exceed anticipated peak levels.

- Keep an eye on system resources like CPU usage, memory, and network performance.

Performance Tracking

During load testing, monitor these key metrics:

- Transaction Times: How quickly transactions are processed.

- Authorization Rates: The percentage of successful payment authorizations.

- Response Times: Overall system response times under load.

- Error Rates: Frequency of errors during testing.

Summary

Key Testing Guidelines

Testing payment workflows demands a structured approach to maintain both reliability and security. Focus on these essential areas:

- Environment Separation: Use sandbox environments that closely mimic live systems, ensuring testing without real transactions.

- Thorough Validation: Check transaction flows, handle edge cases and errors, confirm security compliance, and evaluate performance under heavy loads.

- Automation: Incorporate automated testing into CI/CD pipelines for efficiency and consistency.

A mindset of ongoing testing is crucial to maintaining system integrity over time.

Continuous Testing Approach

Keeping payment systems secure and reliable requires constant updates and monitoring:

- Update Scenarios Regularly: Adapt test cases to align with new features, compliance requirements, and security updates.

- Leverage Tools: Use frameworks and tools (like Best SaaS Boilerplates) to simplify and speed up testing processes.

- Monitor and Refine: Track metrics like transaction success rates, processing speed, and error trends. Use these insights to improve testing coverage and identify weak points.

Recommended SaaS Boilerplates

Below you’ll find three highly endorsed SaaS boilerplates that include all the tools and methods discussed above.