How Payment Failure Notifications Reduce Churn

Timely notifications keep customers informed and engaged, ensuring service continuity.

Payment failures can cause service interruptions, frustrate customers, and increase churn rates. Here’s how timely, clear payment failure notifications help reduce customer loss:

- Quick Alerts: Notify customers immediately about payment issues to prevent service disruptions.

- Actionable Messages: Provide clear steps to resolve the problem, like updating payment methods.

- Multiple Channels: Use email, SMS, or in-app notifications based on urgency and customer preferences.

- Retry Systems: Automate follow-up payment attempts to recover failed transactions.

- Flexible Payment Options: Offer various methods, like credit cards, digital wallets, or bank transfers, to make payments easier.

Tracking metrics like payment recovery rates, response times, and retention impact ensures your notification system is effective. A good strategy not only recovers lost revenue but also builds trust and improves customer retention.

Failed Payments Notifications for Stripe: A Step-by-Step Guide to Solving Customer Payment Issues

Payment Failures in SaaS: Core Concepts

Payment failures can strain customer relationships and lead to increased churn.

Types of Payment Failures

Payment failures generally fall into four main categories:

- Hard Declines: These occur when customer action is required, such as with expired cards, closed accounts, or insufficient funds.

- Soft Declines: Temporary problems that often resolve on their own, like network issues or minor authorization hiccups.

- Authentication Failures: Issues related to 3D Secure verification or other security protocols.

- Processing Errors: Technical glitches during the transaction, either on the merchant’s side or with the payment processor.

How Payment Failures Increase Churn

Immediate Impact:

- Service interruptions can harm customer trust.

- Customers may look for alternatives when outages occur.

- Gaps in service create frustration and friction.

Long-term Effects:

- Persistent issues can weaken customer confidence.

- Frozen accounts disrupt business activities.

- Payment-related challenges often lead to voluntary cancellations.

Understanding these dynamics helps in creating better notifications to address and reduce churn.

Why Payments Fail

Payment failures usually stem from one of three areas:

- Technical Causes: Problems like payment gateway errors, API integration failures, or other processing glitches.

- Financial Causes: Situations such as insufficient funds, maxed-out credit limits, or expired cards.

- Security-Related Issues: Failed fraud checks, incorrect billing information, or mismatches in verification details.

Pinpointing these causes allows businesses to send targeted notifications, helping to minimize churn and improve customer retention.

Payment Failure Notifications and Churn Prevention

Payment failure notifications help minimize customer loss by addressing issues early and maintaining steady revenue flow.

Payment Notification System Basics

An effective payment notification system typically includes the following components:

- Real-time monitoring: Tracks and identifies payment failures as they happen.

- Smart triggers: Sends alerts tailored to specific failure types.

- Multi-channel delivery: Delivers notifications via email, SMS, or in-app messages.

- Retry logic: Automates follow-up payment attempts.

- Response tracking: Measures how well the notifications perform.

It’s important to strike a balance - alerts should be timely but not overwhelming. A well-designed system ensures customers are informed without feeling bombarded.

How Notifications Reduce Customer Loss

Quick notifications give customers the chance to fix payment issues before their service is interrupted. Clear and actionable messages help build trust and encourage them to stay.

Adding direct payment links and simple instructions to notifications makes it easier for customers to update their payment details, reducing any hassle. Personalized alerts, tailored to customer behavior, further improve the chances of resolving issues quickly, keeping churn rates low.

Setting Up Effective Payment Notifications

When to Send Notifications

Notify customers when their payment method is about to expire or if a payment fails. Send timely reminders to help them avoid any service disruptions.

Writing Clear Payment Messages

The best payment notifications are simple, direct, and actionable. Make sure to include these key elements:

- Problem: Clearly state what went wrong.

- Impact: Explain what could happen if the issue isn’t fixed.

- Solution: Provide straightforward steps to resolve the problem.

Here’s a template:

Subject: Action Needed: Update Your Payment Information for [Service Name]

Hi [Customer Name],

We couldn’t process your payment for [Service Name]. If this isn’t resolved soon, your service may be interrupted.

To keep your service running smoothly, please update your payment details by following these steps:

1. Log in to your account.

2. Go to Billing Settings.

3. Update your payment method.

Need help? Contact our support team any time.

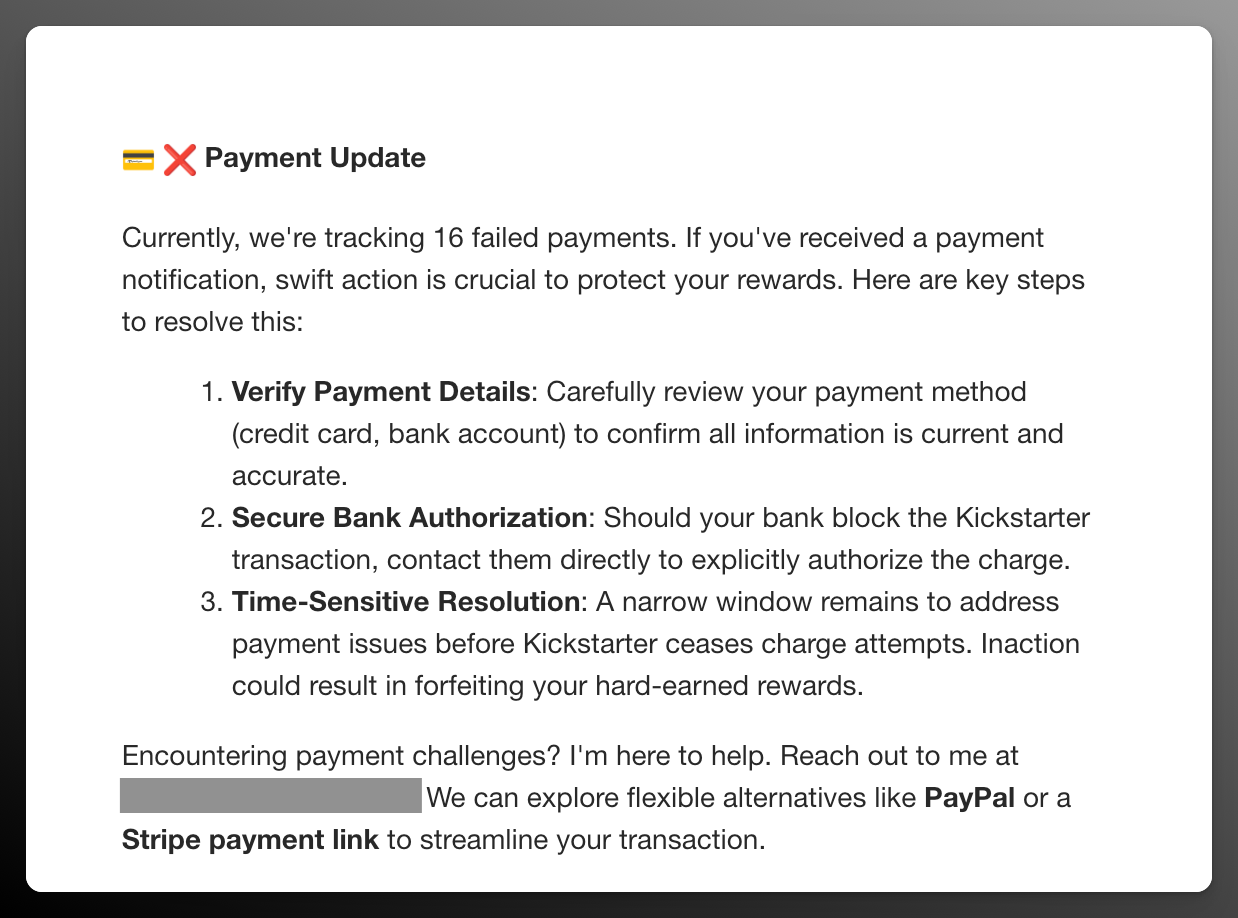

Here’s an actual example from a Kickstarter campaign that I backed:

Once your message is clear, choose the best way to deliver it.

Notification Channel Selection

Pick the right channel - email, SMS, in-app, or push notifications - based on how urgent the situation is and what your customers prefer.

Payment Resolution Instructions

Make it easy for customers to fix the issue by providing clear, step-by-step guidance:

- Direct Payment Link: Include a secure link that takes them straight to their payment settings.

- Alternative Payment Methods: Offer a variety of options, like credit/debit cards, ACH transfers, digital wallets, or bank transfers.

- Support Resources: Add links to FAQs, live chat, or customer service contact details for extra help.

Payment Recovery Steps

Having a clear payment recovery process can help reduce revenue loss while keeping your customers happy. Using early reminders, automated retries, and offering flexible payment methods can significantly improve recovery rates. This approach works hand-in-hand with earlier notification efforts.

Early Payment Reminders

Send reminders before the payment due date to give customers enough time to act. These notifications should include key details like the payment amount, due date, the current payment method on file, and a direct link for updating payment information. This proactive step can help prevent payment issues before they occur.

Payment Retry System

An automated retry system can recover failed payments without causing frustration. Schedule retries at well-thought-out intervals to increase the chances of success while maintaining a smooth customer experience.

Payment Method Options

Offering a variety of payment methods makes it easier for customers to pay. Include options like credit/debit cards, digital wallets (e.g., PayPal, Apple Pay, Google Pay), bank transfers, and region-specific payment methods to accommodate customers in different locations. Flexibility here can make a big difference in recovery rates.

Tracking Notification Success

Success Metrics

To gauge how well your payment failure notifications are working, focus on these key performance indicators (KPIs):

- Payment Recovery Rate: Monitor how often failed payments are successfully recovered over time.

- Time to Recovery: Measure how quickly customers update their payment information after receiving a notification.

- Notification Response Rate: Track the percentage of customers who take action after being notified.

- Channel Performance: Compare how different channels (email, SMS, in-app) perform to identify the most effective ones.

- Customer Retention Impact: Analyze churn rates among customers who receive optimized notifications versus those who don’t.

Improving Results

To make your notifications more effective, rely on data-driven strategies:

A/B Testing Messages

Experiment with different message elements - like subject lines, urgency levels, call-to-action (CTA) placement, and link visibility. Identify which variations lead to better engagement.

Timing and Channel Optimization

Study response patterns to determine the best times to send notifications and which channels work best. Use this data to fine-tune your timing and escalation strategies.

Recovery Flow Analysis

- Examine the steps customers take to update their payment details.

- Track where they drop off and how often they complete the process.

- Identify and eliminate any technical or usability hurdles.

- Simplify the recovery experience based on your findings.

Conclusion

Payment failure notifications play a key role in reducing SaaS churn and maintaining steady revenue. To succeed, your system must be timely, clear, and actionable. Here are some practical steps to follow:

- Notify customers early to prevent service interruptions.

- Offer multiple payment methods to make it easier for users to resolve issues.

- Monitor performance metrics to assess the effectiveness of your approach.

- Communicate clearly throughout the recovery process.

A well-planned payment notification strategy not only helps recover missed payments but also builds customer trust. By creating a system that simplifies recovery and shows customers you value their business, you can improve retention and enhance their overall experience.

Use performance data and customer feedback to fine-tune your approach, reduce churn, and support long-term growth. Focusing on effective payment failure management strengthens relationships with customers and contributes to your business’s success.

Recommended SaaS Boilerplates

Below you’ll find three SaaS boilerplates that come highly endorsed by the dev community this month.