Dunning Management Tools for SaaS Payment Recovery

Essential dunning management tools for SaaS businesses to automate payment recovery, reduce churn, and enhance customer retention.

Recovering failed payments is vital for SaaS businesses to reduce churn and maintain steady revenue. Dunning management tools automate this process by retrying payments, sending reminders, and resolving issues like expired cards or insufficient funds. Here’s a quick look at five top tools to help you recover lost revenue and improve customer retention:

- Baremetrics: Advanced analytics and smart retry scheduling. Starts at $69/month.

- Chargebee: Best for global businesses with multi-currency support. Free for the first USD $250K of cumulative billing, then 0.75% on billing for startups.

- Recurly: Machine learning-powered retries for complex subscriptions. Free for first 3 months, then $249/month.

- Stripe: Seamless integration with Stripe Billing, priced at 0.5% of recurring charges.

- Churn Buster: Focused on personalized recovery campaigns. Starts at $350/month.

Quick Comparison

| Tool | Starting Price | Best For | Key Strength |

|---|---|---|---|

| Baremetrics | $69/month | Medium-large SaaS | Analytics integration |

| Chargebee | 0.75% of charges | Global businesses | Multi-currency support |

| Recurly | $249/month | Complex subscriptions | ML-powered retries |

| Stripe | 0.5% of charges | Stripe users | Native integration |

| Churn Buster | $350/month | Recovery-focused | Specialized campaigns |

Choose a tool based on your budget, business size, and payment recovery needs. Each tool offers unique features like retry logic, pre-dunning notifications, and analytics to help you minimize involuntary churn and maximize revenue.

Streamline Your Dunning Process for B2B Subscriptions

5 Leading Dunning Tools for SaaS

Choosing the right dunning tool can make a big difference in recovering lost revenue. Here’s a breakdown of some top options.

Baremetrics

Baremetrics combines dunning management with powerful subscription analytics and revenue recovery tools. Its system uses smart retry logic to adjust payment retries based on past success rates.

- Smart retry scheduling with up to 15 attempts

- Automated email campaigns featuring A/B testing

- Real-time analytics for payment failures

- Custom-branded payment update pages

Starting at $69/month, Baremetrics is best for SaaS companies that are just starting out.

Chargebee

Chargebee integrates directly with its subscription billing platform, making it a great fit for businesses with complex billing needs. It offers extensive customization for recovery workflows.

- Multi-currency support for global customers

- Pre-dunning notifications for expiring cards

- Intelligent retry schedules tailored to failure reasons

- Automated card updater service

Pricing begins at 0.75% per transactionfor businesses processing up to $250,000 in revenue. It’s particularly useful for SaaS companies with international audiences.

Recurly

Recurly specializes in subscription management and offers robust dunning features. Using machine learning, it optimizes retry schedules to reduce involuntary churn.

- ML-driven retry optimization

- Custom dunning rules by customer segment

- Built-in analytics for revenue recovery

- Multi-gateway failover support

Starting at $249/month, Recurly is ideal for businesses with complex subscription models that need advanced retry logic.

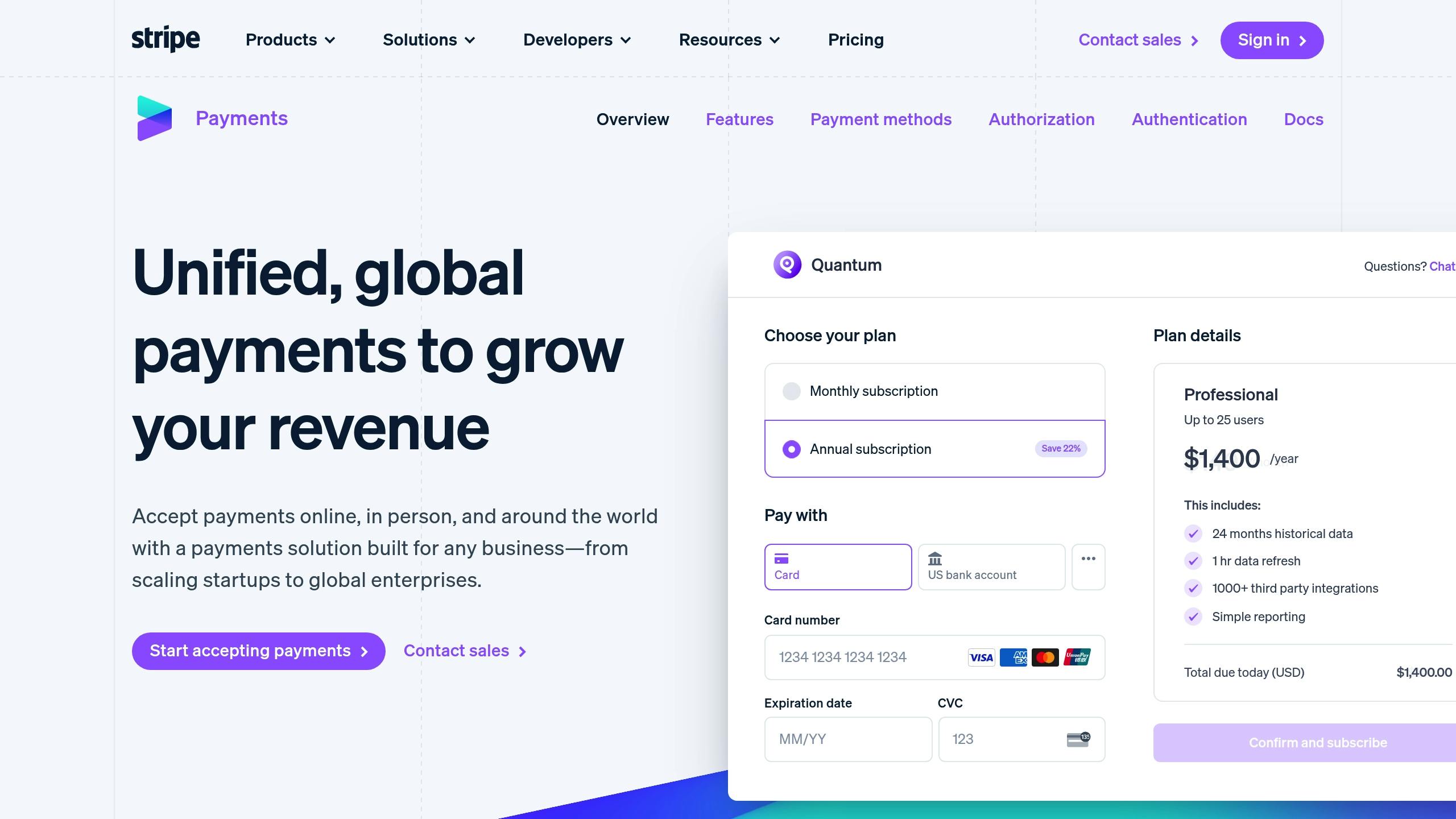

Stripe

Stripe includes dunning tools as part of its Stripe Billing product, seamlessly integrating with its payment processing system. It focuses on minimizing failed payments with automated solutions.

- Automatic card updates through card networks

- Smart retry attempts

- Customizable email templates

- Integrated customer communication tools

Pricing is usage-based, with a 0.5% fee on recurring charges. Stripe’s dunning tools are best for businesses already using their payment processing services.

Churn Buster

Churn Buster is a specialized payment recovery platform for SaaS businesses. It focuses on personalized recovery campaigns and detailed analytics.

- Optimized campaign scheduling

- Branded payment update pages

- Advanced retry logic

- Detailed reporting on recovery efforts

Starting at $350/month for up to $50,000 in MRR, Churn Buster is ideal for businesses that prioritize personalized recovery strategies.

These tools offer a wide range of approaches, from automation and machine learning to tailored recovery campaigns, ensuring there’s a solution for every SaaS need.

Selecting a Dunning Tool

Key Factors to Consider

When choosing a dunning tool, focus on features that improve payment recovery. Evaluate your business size and budget to find a pricing model that fits.

Here are some important factors to keep in mind:

- Payment processor compatibility: Ensure the tool works seamlessly with your payment gateway.

- Flexible recovery workflows: Look for options to customize retry schedules and communication sequences.

- Analytics: The tool should provide clear metrics to track recovery performance.

- Automation: Check for features like smart retry logic and automated customer communication.

- Cost-effectiveness: Compare the tool’s costs with the potential improvement in recovery rates.

Technical Requirements

Once you’ve identified the features you need, confirm that your existing tech stack can support the tool.

Payment Gateway Integration:

- Works with your payment processor.

- Supports your billing model.

- Integrates with your customer database.

- Provides the necessary API access levels.

Platform Compatibility:

- Fits with your server infrastructure.

- Meets data security standards (e.g., PCI DSS, GDPR).

- Works with your authentication systems.

- Offers reliable backup and redundancy options.

Customization Options

After ensuring technical compatibility, focus on personalizing the tool to align with your brand and customer communication style. Customization options may include:

- Email templates and messaging: Adjust tone and content to match your brand voice.

- Payment page branding: Ensure the look and feel are consistent with your website.

- Retry schedules: Fine-tune the timing and frequency of payment retries.

- Customer segmentation: Create targeted communication strategies for different customer groups.

Transform your business idea into a revenue-generating SaaS in record time. Explore our curated collection of ready-to-launch boilerplates designed for developer-entrepreneurs who want to validate concepts, acquire customers, and start monetizing immediately. Browse Boilerplates

Dunning Management Tips

Fine-tuning your dunning strategy is essential to reduce payment failures and keep churn rates low.

Payment Reminder Schedule

Plan your payment reminders thoughtfully to minimize missed payments:

- 7 days before renewal: Send the first reminder.

- 3 days before expiration: Follow up with another notice.

- Renewal day: Issue an alert as a final nudge.

- Post-failure reminders: Send notices at 3, 7, and 14 days after failure.

For high-value accounts, consider customizing the timing to align with their preferences or payment patterns.

Once your schedule is in place, focus on crafting clear and effective messages.

Customer Message Templates

Your messages should be concise and action-oriented to encourage quick payment resolutions:

- Be upfront: Clearly state the issue and what the customer needs to do.

- Highlight benefits: Remind them of the value they’ll retain by resolving the issue.

- Create urgency: Stress the importance of acting quickly to maintain uninterrupted service.

- Offer solutions: Include direct payment links and multiple support options.

| Component | Guidelines | Goal |

|---|---|---|

| Subject Line | ”Action Required: Update Payment Method” | Clear intent |

| Opening | Specify the issue immediately | Provide context |

| Action Steps | Use simple, numbered instructions | Ensure easy follow-through |

| Deadline | Include a clear timeframe | Add urgency |

| Support | Offer multiple contact methods | Ensure accessibility |

Test different templates to see what resonates best with your audience.

Testing and Results

A/B testing is key to refining your dunning messages. Experiment with the following elements:

- Subject lines

- Sending times

- Placement of calls-to-action (CTAs)

- Tone and length of the message

Track these key metrics to measure success:

- Percentage of recovered payments

- Average time it takes to recover payments

- Response rates based on message type

- Success rates for updating payment methods

Review these metrics every quarter to identify trends and optimize your strategy. Segment customers by factors like subscription tier, payment history, or engagement level to create targeted recovery plans that work better for specific groups.

Tracking Dunning Results

Once you’ve refined your dunning process, it’s crucial to keep a close eye on its performance. Consistent tracking helps you identify areas for improvement and boost recovery efforts.

Performance Metrics

Pay attention to these key metrics:

- Payment Recovery Rate: The percentage of failed payments that are successfully recovered.

- Average Recovery Time: How long it takes, on average, to resolve a failed payment.

- Churn Prevention Rate: The percentage of customers retained thanks to your recovery actions.

- First Attempt Success: How effective your initial payment retry is.

- Customer Response Rate: How often customers engage with your dunning communications.

These metrics can help you spot patterns and refine your approach.

Industry Standards

Recovery rates can vary depending on issues like expired cards or insufficient funds. Compare your performance to industry benchmarks to see how you stack up. Also, review timing standards, such as how long you wait before the first retry and the total recovery window. Keep in mind that these benchmarks can differ based on your pricing, customer base, and business model.

Regular Updates

Set up a routine review schedule to stay on top of your dunning process:

- Short-term reviews: Tackle sudden increases in failed payments quickly.

- Periodic analyses: Study trends and see how effective your communications are.

- Strategic adjustments: Use the data you collect to fine-tune your approach.

Keeping your tracking process consistent ensures you’re always improving.

Summary

Effective dunning management helps recover lost revenue and reduce churn. By using the right tools and strategies, businesses can improve payment recovery while maintaining good relationships with their customers.

A successful dunning approach blends automation with thoughtful communication to streamline recovery efforts across all channels. The secret lies in choosing the right tools and fine-tuning workflows. Focus on these key areas:

Improving the Recovery Process

- Adjust retry schedules based on payment failure trends.

- Use automated tools to keep payment details up to date.

Enhancing Customer Experience

- Craft branded recovery emails that resonate with customers.

- Offer a variety of payment methods to make it easier for users.

- Provide self-service portals for updating payment details.

- Send clear and concise updates on payment status.

Tracking and Measuring Performance

- Monitor recovery rates by different failure types.

- Keep an eye on how long it takes to recover payments.

- Assess how recovery efforts impact customer retention.

- Evaluate the effectiveness of communication strategies.

These performance metrics are important for refining your dunning strategy. Regular updates and improvements to every part of your process - whether it’s technical integration or customer messaging - are essential.

Investing in dunning management not only improves cash flow but also reduces churn and builds stronger customer relationships. Consistent reviews and optimizations ensure recovery rates remain high.

Recommended SaaS Boilerplates

Below you’ll find three recommended SaaS boilerplates that incorporate dunning management tools.